Our journey

Raf Van Gorp founded Ravago in 1961 when he had the opportunity to buy the premises of a dynamite company in Arendonk, Belgium. This enabled him to work out the luminous idea he had: recycling production waste from the plastics producing petrochemical companies.

From there, Ravago grew into a comprehensive service provider to the petrochemical industry, constantly pushing the boundaries of plastics applications and bringing the (re)use of plastics to a next level, with sustainability continuously on our mind. Over the years, the ambition of global expansion and market leadership in polymer and chemical distribution, recycling and compounding, and building materials, became a reality.

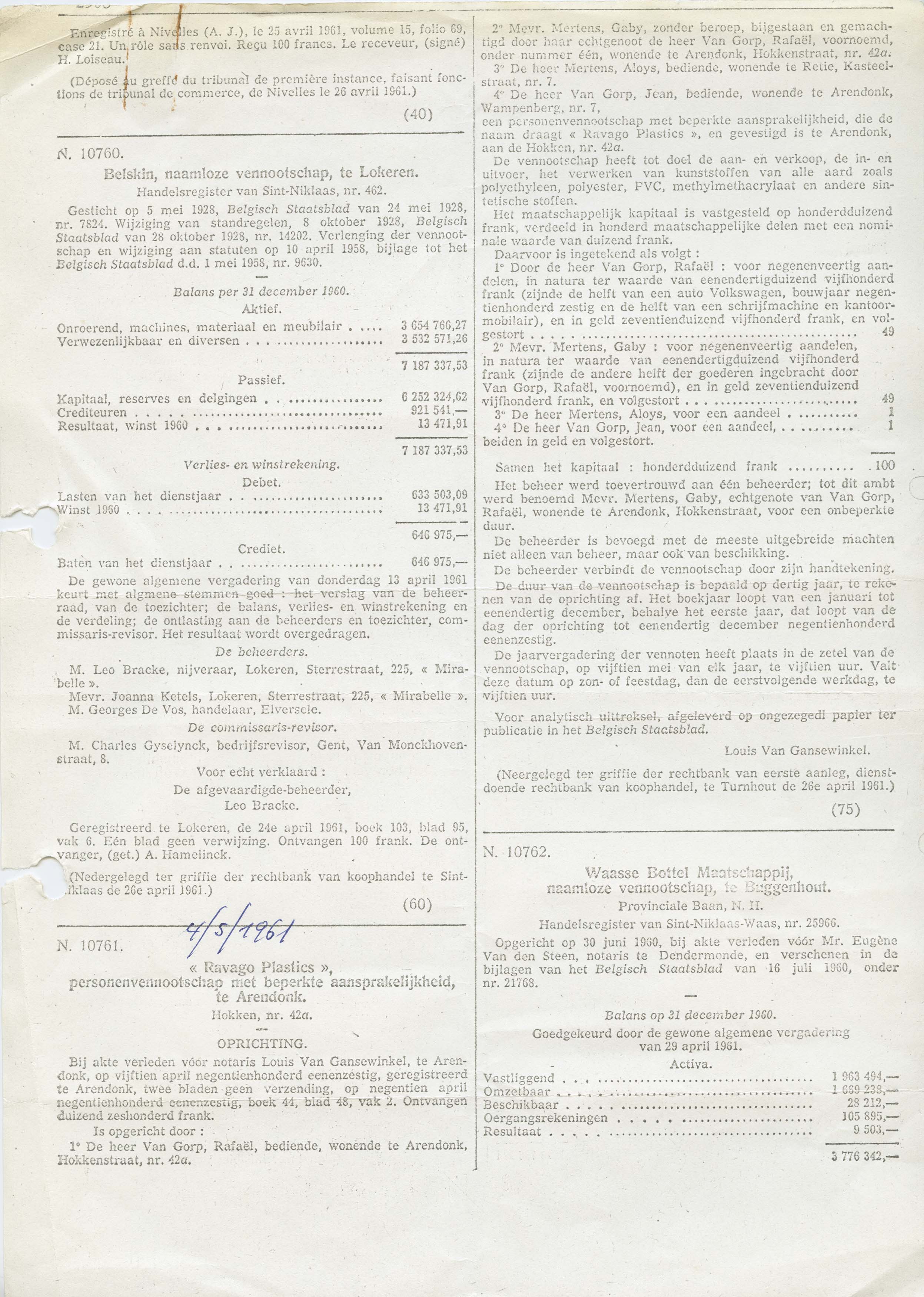

Poudreries Réunies de Belgique - 1961

When Raf Van Gorp started working as a clerk in Poudreries Réunies de Belgique (PRB), a subsidiary of the former Generale Maatschappij van België, he probably didn’t realize that this gunpowder factory would become the geographical fundament of his own industrial dream. Working in a sub-division of a large Belgian conglomerate, it wasn’t long before Raf began operating on an independent basis. Benefiting from the commercial and financial relations of the company he was working in, his early activities consisted of buying and selling industrial waste outside working hours.

"We had to do more with every penny we earned."

Scrap was Raf’s first choice. All kinds of finished products were stored in the first warehouse in de Hokken (Arendonk, Belgium): leftovers from cardboard and paper, fabric from old chairs and used buckets. Items that seemed useless in the eyes of the world were perceived as business opportunities by the young entrepreneur. He provided what people asked for but added a personal touch. What began as a casual job, selling from door to door, turned into something more official when Raf Van Gorp decided to direct his activities from his garage in a rented house.

"We have to forget our perception of wealth.

The purchasing power of those days isn’t imaginable today."

A suitable correlation for the concept of setting up a business in the 1960s is perhaps that of managing a family: Raf Van Gorp’s first colleagues were people he knew so trust wasn’t an issue. They included fellow staff from PRB, card-playing friends, family members: all were granted the same level of trust to come and join him in his modest enterprise. In spite of their normal everyday jobs, these people were grateful for the opportunity offered to them: they sought contact with potential customers, while the founder of Ravago was creating ties with future suppliers. As solidarity grew between the colleagues - they felt part of the same secret family - so did the enterprise as a whole. The search for materials on the fringes of the industry was gradually expanded by introducing first choice products in the portfolio: polyethylene film, PVC pipes and new flooring were adopted in the improving business.

"To lead means to create trust and then

carry out a number of controls."

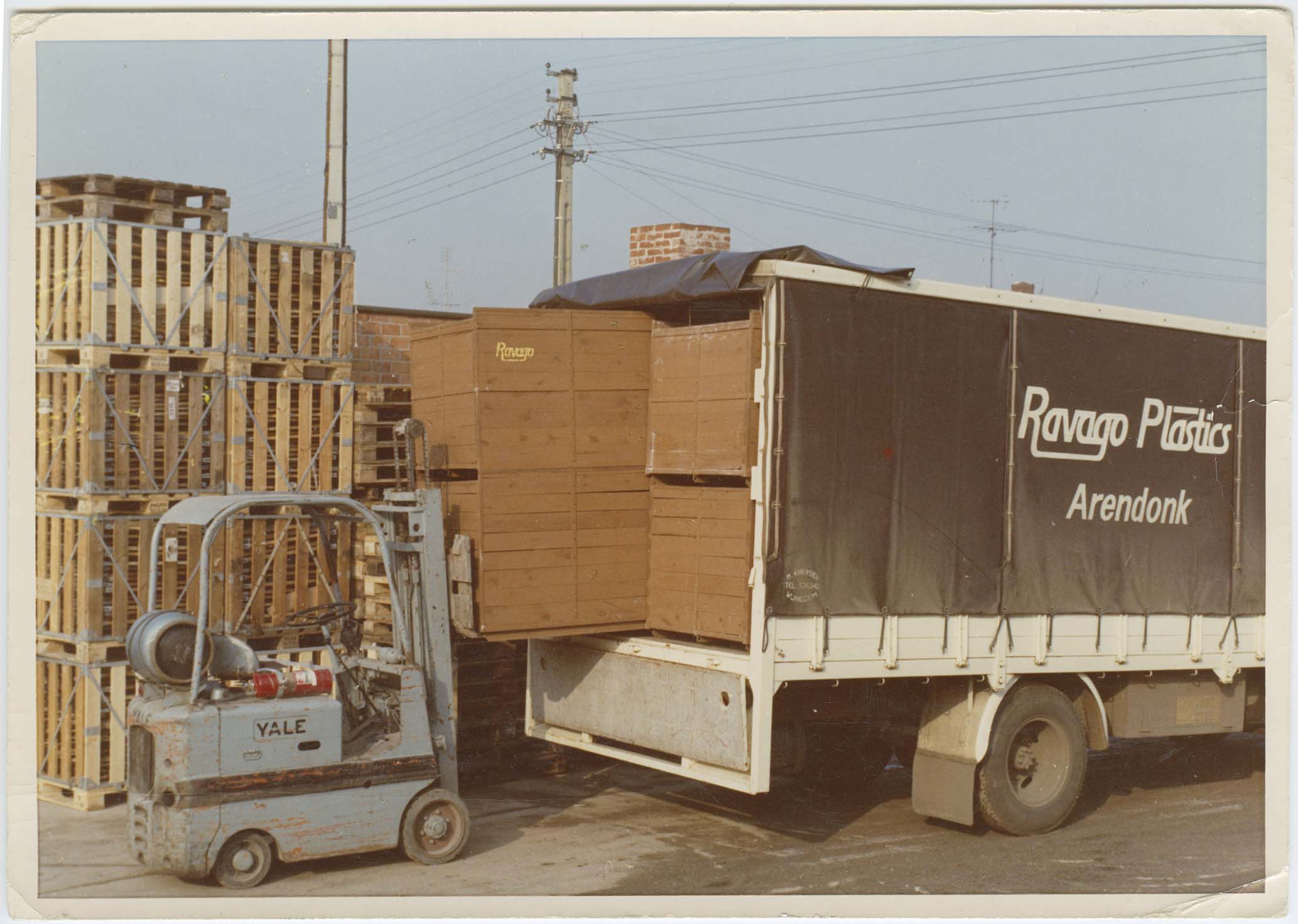

Growth is the only way to survive: this has consequences both for natural and legal persons. In the early years, survival was obviously a more important premise than growth: Ravago was created with a starting capital of BEF 100,000 (equal to EUR 2,480) and high financial leverage. If we compare Ravago’s initial position with today’s situation, growth has resulted in continuous expansion and reorganization: this strategy was inherited from Ravago’s beginnings. As the first garage became too small for the enterprise’s large-scale ambitions, warehouses were rented in the centre of Arendonk in order to stock all kinds of materials. The lack of industrial equipment during the first five years – the only permanent asset was a Volkswagen (plus a trailer) contributed by the founder in the memorandum of association in 1960 – meant that the Ravago family had to work hard, in all senses of the word, in order to earn every penny and respect in the market in which they operated in. It was over ten years before they bought the first fork-lift truck.

Brug 4 & Brug 5 - 1966

During the first five years, Raf Van Gorp continued to work at Poudreries Réunies de Belgique while he was developing his own business: it was only in 1964 that he was able to focus on it 100%. When PRB closed in 1966 a crucial deal was sealed: the factory director offered his loyal employee the industrial site at a bargain price. The early profit was immediately reinvested; moreover Raf Van Gorp had already acquired the area where the central offices are still located today. Since the PRB warehouses formerly served as a disposal area for waste material, the new owner benefited from these fixed assets: in the next few decades they would become the nucleus for each of Ravago’s new developments. Raf Van Gorp had a clear division in his mind when he bought the two sites: on the one hand, Brug 4 would act as center for finished products and the accounting department, and on the other hand, Brug 5 would be used as center for raw materials as well as the logistics and administrative department.

"In those days, business was an adventure:

every day was a surprise."

It would be over-ambitious to summarize ten years of history in one paragraph; nevertheless, we must endeavour to do so. While the world was experiencing “the golden ‘60s”, driven by the Cold War and socialist revolutions, the members of the Ravago family were fighting on a smaller though no less important scale for the consolidation of what they considered to be their creation. When the company was set up, Raf Van Gorp’s modest contribution consisted of a Volkswagen, a typewriter, some office furniture and BEF 5,000 (EUR 125). Just a few years later, Ravago would already have a paid-in capital amounting to BEF 15 million (EUR 375,000) on the balance sheet. It would eventually become clear that the initial urge to survive, automatically served growth in the long run.

"The mentality has changed a lot. In the 1960s, earning money

was considered to be a privilege."

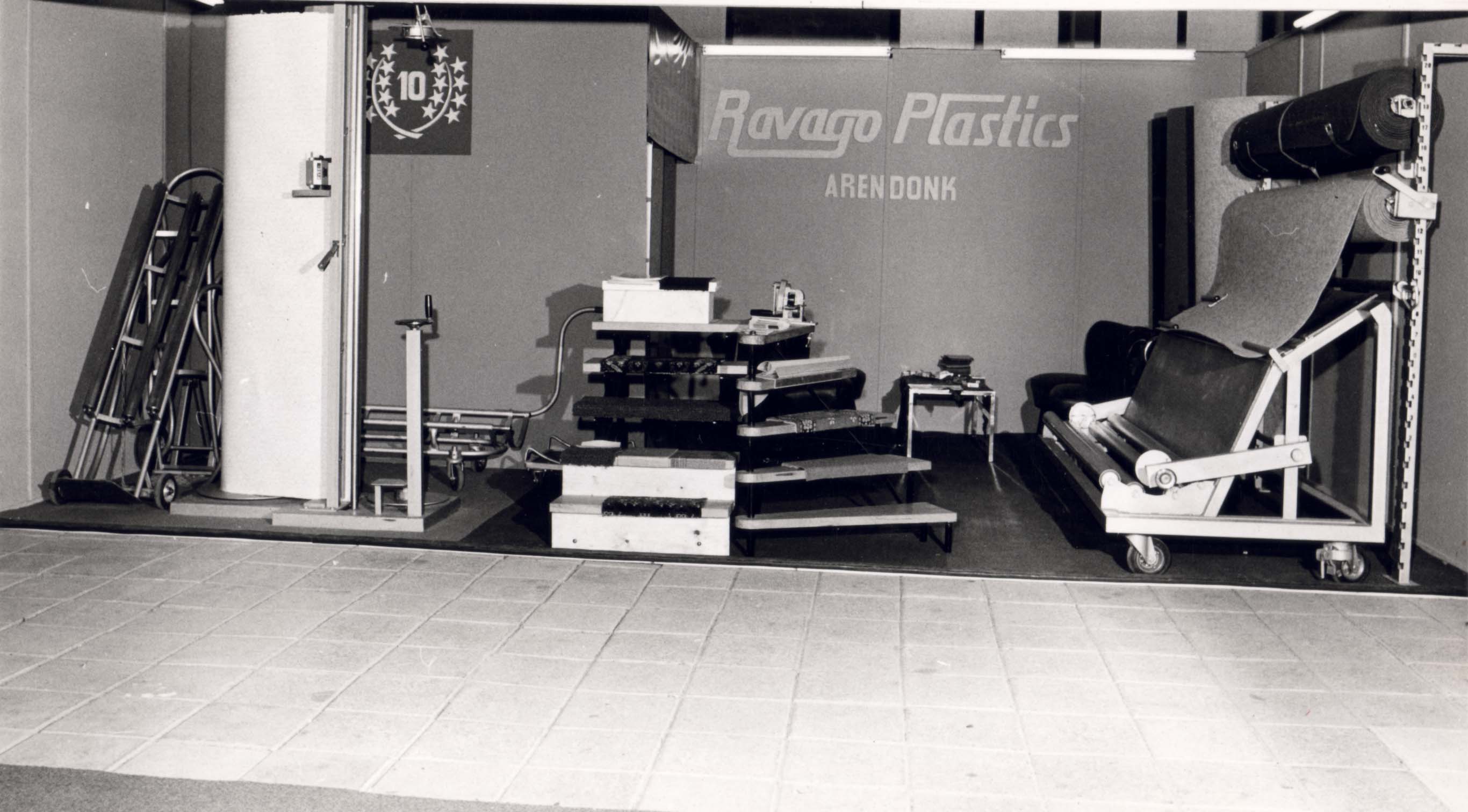

Trial and error - 1970s

The beginning of the 1970s was marked by a series of international events that had a negative effect on the global economy in the short and medium term; nevertheless, in the long run, they appeared to be of great economic significance for industrial companies dealing with commodities. At the outbreak of the Yom Kippur War in 1973, and the subsequent U.S. support for Israel, OPEC members declared an oil embargo on Western nations. Oil production and related exports were significantly reduced, which led to soaring inflation worldwide. Consequently, the prices of raw materials continued to rise until the Iranian Revolution broke out at the end of the decade.

"Don’t try to be the best.

Try to work with the best."

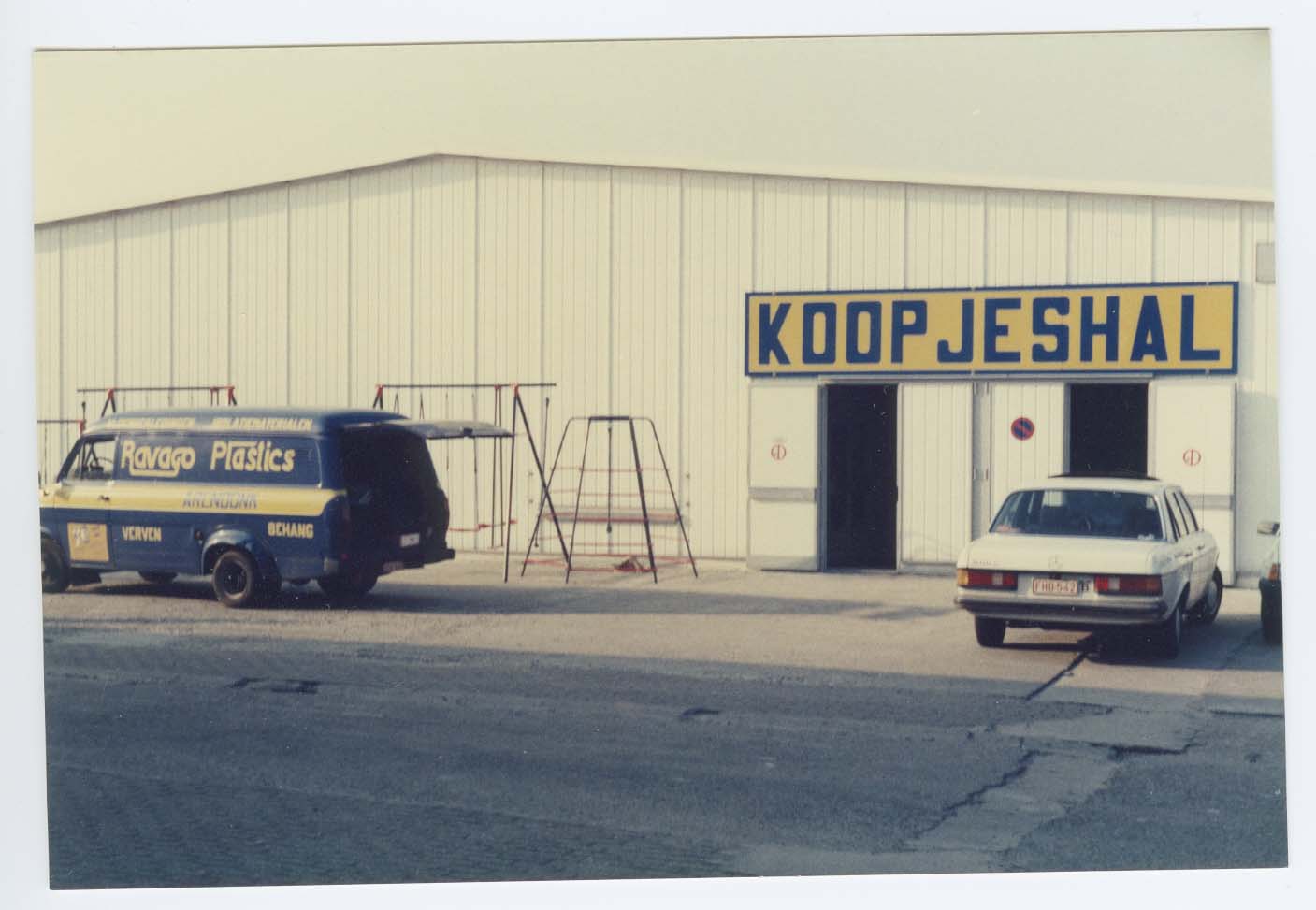

Although macroeconomic contingencies weren’t the main concern in the day-to-day struggle of the Ravago family, these events had major implications indirectly regarding future developments: as the price of the feedstock rose sharply together with the oil prices, the chemical derivatives from the black gold which was kept in stock, increased in value over time. As this led to a higher sales price, operating profit was increasing simultaneously, which eventually allowed Ravago to attempt its first foreign expansion. At the time, domestic expansion was already taking place with the creation of local “plastic shops” which sold all sorts of goods such as buckets, ribbon, carpets, paint, etc.

"A shepherd doesn’t walk in front of his herd,

but follows behind in order to steer it."

Throughout the entire history of Ravago, its headquarters have been based in the Flemish-speaking part of a trilingual country: it is worth mentioning here that Belgians have always had one major advantage over their neighbours, i.e. the ability (and need) to speak other languages. French, German and English: the strength of being able to adapt should not be underestimated since language is one of the keys to understanding someone else’s (business) culture. Finally, France was chosen as the location for Ravago’s first international venture.

"Change is contrary to human nature since it requires effort and energy.

Change incites resistance among those who wish to maintain the status quo."

The international tone of the growth strategy was set, and Ravago seized every opportunity that presented itself. In 1979, Ravago Plásticos was the next big step on a European scale: the lovely Catalan village of Vilallonga would soon become the petrochemical heart of Spain and therefore a strategic manufacturing post, which blossomed into one of the largest recycling and compounding facilities on the Iberian Peninsula. Meanwhile, the Belgian integration in polymers continued both vertically as horizontally: the acquisition of the bankrupt UMAC-Midwest from The American Banknote Corporation meant that Ravago also became a rubber pioneer. The second decade of the company’s existence would end in the same way it had started: with a crisis.

Balance between autonomy and control - 1980s

The entrepreneurial boldness of the Ravago team is indeed admirable. International ambition was present right from the start: doubts concerning failure in the short-term were continuously replaced by the conviction of a greater benefit in the long run. The greatest admiration, however, must be reserved for the similarities in business culture that transcended borders. “Business culture” cannot be defined in general terms and then implemented as such; it is a subtle process and the end goal is never fully accomplished. Professional training, mutual understanding and common objectives are necessary conditions but not sufficient in themselves. An international company’s success in achieving a uniform business culture cannot be interpreted from the monthly balance sheets drawn up by a foreign subsidiary: only people provide the evidence over the years.

"A self-confident opinion can persuade other people

of the truth of one’s conviction."

The European expansion, which started at the end of the 1970s, continued throughout the 1980s: France, Germany, Greece and Italy were amongst the various locations. As the member states of the European Economic Community grew, the number of Ravago group members also continued to grow.

"If you have five stubborn cockerels,

you had better provide a dunghill for each one of them."

The team from Arendonk not only consolidated itself in Europe; internationalization also took place on US soil, which meant the first step overseas. Foreign entities sprouting like mushrooms meant an increased need for transparency: the three-way split into a holding, investment and production company in 1988 found its roots within the same philosophy. The global economy improved slowly after the second oil crisis: a period of high inflation and modest economic growth determined the first few years of the next decade, while in the second half of the 1980s, the markets flourished once again until the next crisis struck, resulting from the same place as the previous one: the Middle East.

Open curtains - 1989

On macroeconomic level, the Cold War was starting to crumble towards the end of the 1980s. In the meantime, Ravago was consolidating its position in the communist satellite states: personal contacts with East European state-owned companies were transformed into business opportunities, since materials at substantial lower cost were being sourced from remote regions. The collapse of communist ideology culminated in the symbolic decline of the Berlin Wall in 1989. Despite the fall of the Iron Curtain, Ravago maintained its former commercial relations with the Eastern Bloc, which eventually helped to strengthen the company’s position in those markets. As a result of these events, the European movement towards reunification was reinforced with the signing of the Treaty of Maastricht in 1993: the decline of statehood and the subsequent freedom of movement (of persons, capital, goods and services) beyond national borders, resulted in a boost for international players, such as Ravago.

"We’ve never stolen anything from anyone.

Everything that we are today, we built up with our own hands."

"The main concern of management must always be the continuity

of the business, which it must lead towards the future."

1993 was the year of a sad event: the immortality of Ravago could not alter the fact that the life of every human being has to come to an end at some point. The man who did his military service in Wallonia, who wrote weekly sports articles in the local newspaper, who enjoyed playing cards with his friends, who sponsored every charity event, who was regarded as a guru within the plastic industry, who benefited from significant influence in the banking world, who loved to stop by at the (Belgian) chip shop every once in a while and whose most wonderful quality was the way he inspired, motivated and managed his people, died at the early age of 62.

"He remained human his whole life."

The best of both worlds: East & West

For Ravago, the 1990s proved to be very profitable as the group continued to follow the only viable path for a company: that of growth. As an industrial company, Ravago strengthened its commercial ties by observing the world at large: acquisitions, joint ventures and participations were the means to achieve its ambitious goals. Opportunities were converted into business relations, many of which resulted in personal friendships. Moreover, suppliers supported this evolution in a spirit of partnership, which led to a conceptual expansion of the markets. As a consequence of this global vision, local costs would increase significantly, a situation that forced Ravago to start working more efficiently in the following decade.

"Our company’s strength lies in the way that trust is

granted in balance with internal control."

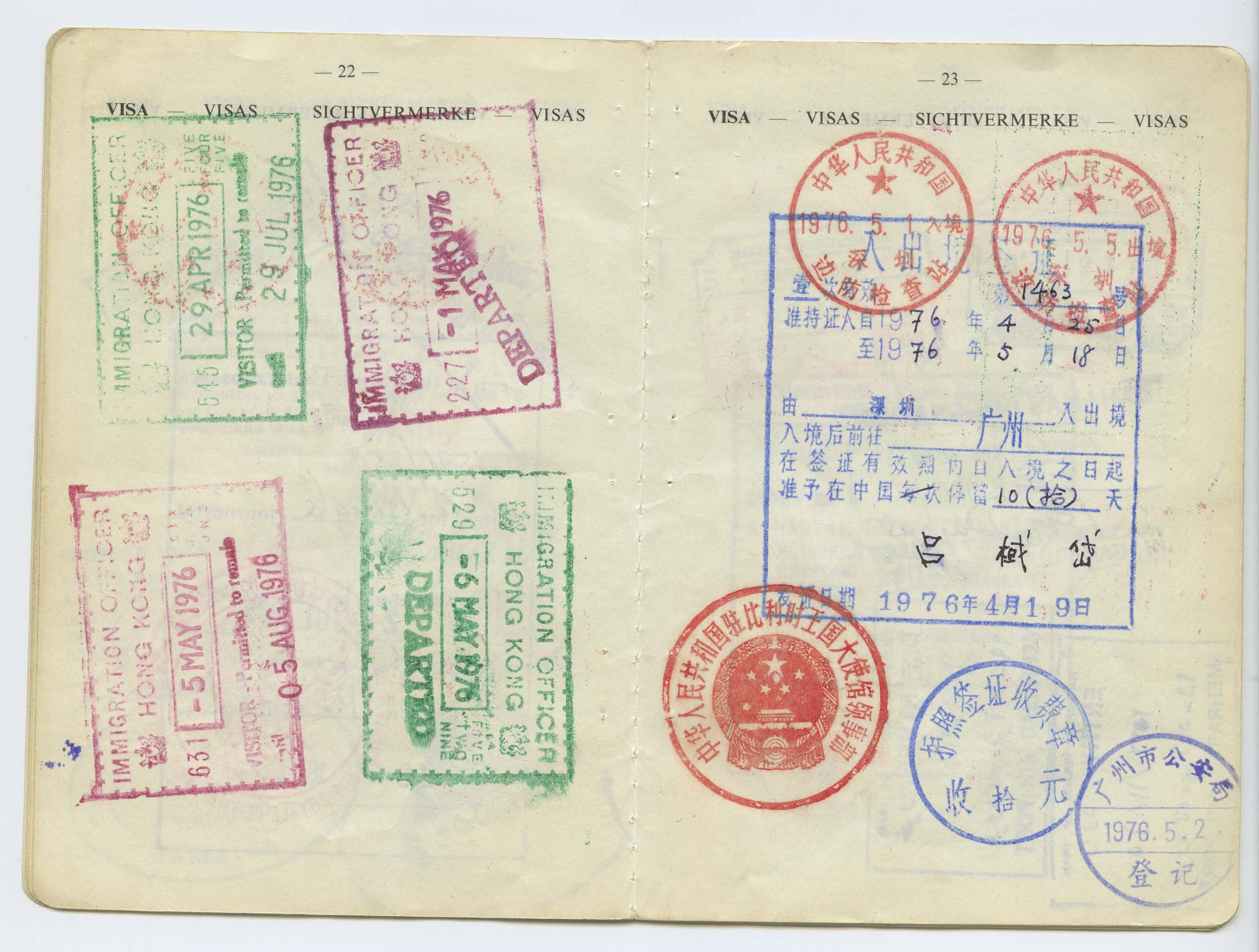

Entec (USA), Ravago Hong Kong (SAR China), Polymed (Middle East), Plastomark (South Africa), Ravago Turkey: geographically Ravago’s commercial coverage was global and exceeded every territorial restriction. Horizontally, the group broadened its business scope by sealing a chemical partnership with Campi y Jove. Distribution was developed on a pan-European scale: one of the largest plastic and rubber distribution networks was set up thanks to external support and internal belief. On the manufacturing side, Ravago professionalized its compounding activities: engineering plastics, specialty products and high-end applications added a new dimension to the existing model. Both the production and distribution division would benefit from the profitability of this high-margin business.

"The smaller the big world becomes,

the bigger the small things become."

While the introduction of computer systems was revolutionary in the 1980s, the invention of the World Wide Web certainly became the main challenge in the 1990s. The possibilities seemed endless with the whole world becoming connected. As a global player, Ravago adapted accordingly: its entry into the new millennium was one of consolidation after the internet bubble burst in the aftermath of the Asian crisis at the end of the 1990s.

Millennium of change

The fear of a global meltdown (“Y2K”) was unfounded when the New Year was brought in on 1st of January 2000; the unpredictability of the future, however, was seen once again in the events that occurred in the following months. The revolutionary boom of internet at the end of the 1990s and the consequent blooming of Silicon Valley dot-coms led to a significant amount of IPOs at the start of the next decade. Within a context of abundant liquidity in a market of easy investment money, these young entrepreneurial SMEs fuelled this excessive positivism, which eventually led to a period of correction; the economic pendulum had found its balance again by 2002.

"Things are never as good, nor as bad as they seem."

The storm that raged throughout the virtual world also had its consequences for the Ravago group, albeit in a positive way. The IT system – until that moment every legal entity had used its own local programs – was to be centralized within Europe: with the cooperation of IBM, the IT department created its own system instead of buying a standard order-processing package. The program initially worked as a trade system, where the purchase of one lot was offset against several sales orders, but commercial reality soon required it to evolve into an innovative distribution system: the stock of one type of material could be built up through different purchases and its availability could vary over time. Ohm was born.

"Ravago’s success?

A philosophy of daily discipline and unconditional commitment."

An unfortunate strength of human nature is the ability to forget: on the one hand, a person committing an error will endure the consequences and will therefore continue to look towards the future; on the other hand, his short-term-memory will make him commit the same mistake over and over again. Even ten years can be a very long time for the human memory to recall. The Arab-Israeli war in the 1960s, the Yom Kippur war in the 1970s, the Iran-Iraq war in the 1980s, the Gulf war in the 1990s: the bad blood created over fifty years of warfare in the Middle East resulted in a radical incomprehension of the Western world. The sheer depth of the fundamentalist roots became tragically clear with the 9/11 attacks. For every eye lost another would be taken: Iraq and Afghanistan would (again) become “new” victims of the short-sighted human viewpoint. The side effects of warfare were to become a long-term reality: Middle Eastern economies would remain frail, American public expenses would skyrocket and European powers would fall in between, both geographically as politically.

"People are the same worldwide: only the percentages differ."

Amid the international turmoil Ravago would stand up and fight their plastic battle. North American Group (2005) and Muehlstein (2006) were integrated in the group: in the Americas Ravago would consolidate its footprint both by organic growth and acquisition of long-standing companies in the field. The fusion of both resale and distribution channels would strengthen the qualitative strategy and geographical presence, which would very soon result in a homogenous fit.

"Think global, act local."

"Global perspective, personal expertise."

Crisis 2008

Few things went wrong with the global economy between 2002 and 2008: company’s profits skyrocketed, stock markets generated exceptional returns, property developers pocketed the cash from large real estate projects. On the one hand, the USA was driving the world with debt, while on the other hand, China was collecting American public bonds with its trade surplus. European budget deficits were accumulating year after year and fueling the long-term national debt; a phenomenon countries could easily disguise through rollover public financing in an overoptimistic environment. Nobody seemed concerned, since liquidity was not an issue in the lenders market. One word ruled the new century: derivatives.

"In business you have to box and dance:

stimulate and correct at the appropriate moment."

The origin of the derivatives market is not a recent one: in ancient times, the technique was already used by grain merchants who were trying to fix their contract prices in order to secure business profit and to be free from any risk. Dealers would seal a future contract: if the contract price differed from the market price on the due date, the buyer of the contract would have the option to demand the payment of the difference or to require execution of the contract (i.e. physical delivery of the placed order).

A tool, originating in an agricultural context with the purpose of limiting one’s exposure to external hazards, developed over the years to become a major financial instrument in order to cash in on lucrative operations. This speculative paper business generated a bubble, which burst in September 2008. The trigger for the explosion came with the bankruptcy of Lehman Brothers, inducing bailouts of the world’s largest financial institutions and the subsequent contamination of different segments related to the global economy: a real estate crisis reaching from Spain to Dubai, a soaring unemployment rate spanning the USA to the UK, a growing government deficit from Ireland to Greece that suddenly became intolerable and was therefore punished by both the rating agencies and bondholders.

"The value of the commodity should be based on the application of

the finished product and not be related to the profit of securities trading."

This worldwide shock wave hit many companies and Ravago wasn’t spared from the impact. As banks were taking potential losses due to having to write off bad debts (which determined the underlying value of their intangible assets), liquidity quickly dried up. Consequently sales orders declined because suppliers and customers were operating in financial uncertainty, and credit rating agencies downgraded formerly healthy companies. In order to avoid drowning, Ravago’s management had to take several drastic and unfortunate decisions. In spite of the difficult times suffered by all family members, the company seemed to resist. Eventually, despite the world suffering its worst economic crisis since the 1930s, Ravago was able to cope efficiently: even at its darkest hour, the company remained healthy.

Emerging opportunities

The future of Ravago will be determined by the inherent drive of insiders: group members will continue to integrate and converge, the organization as a whole will continue to grow both internally (by attracting young talent) and externally (by being receptive for further expansion) and businesses will continue to adapt in line with rapidly changing environments.

"While the members of the Old Guard preserve a sentimental feeling

of affection for their company, Ravago creates an impression and a feeling of admiration among newcomers."

Just like the Ravago tree extends its branches outside the square in the logo, Ravago continuously looks for market and regional diversification. Chemical distribution became a new core business of the Ravago group, polymer distribution and manufacturing expanded to Oceania and India, and our building materials expertise shifted from a distribution to manufacturing activity. This realized an expanded footprint in new and existing Ravago markets and activities.

Global acceleration

Since 2020, the world has been confronted with acceleration. The Covid-19 pandemic increasingly exposed some global challenges, as well as opportunities for Ravago. On the one hand, many of us were forced into new ways of (digital) working and the impact of rapidly changing environments was tangible. It is here to stay. Digitization has become a crucial component of diversifying our distribution activities. On the other hand, waste solutions have rightly received more attention. Investing in our recycling activities and partnering with front runners in this industry are key strategic choices of the Ravago group. It will be crucial for future generations.

"We want to give back to the world what it has given us."

Want to take part in our journey?

Ravago is continuously on the lookout for new talent!

Discover our vacancies or apply spontaneously >